Difference Between S Corporation And Llc

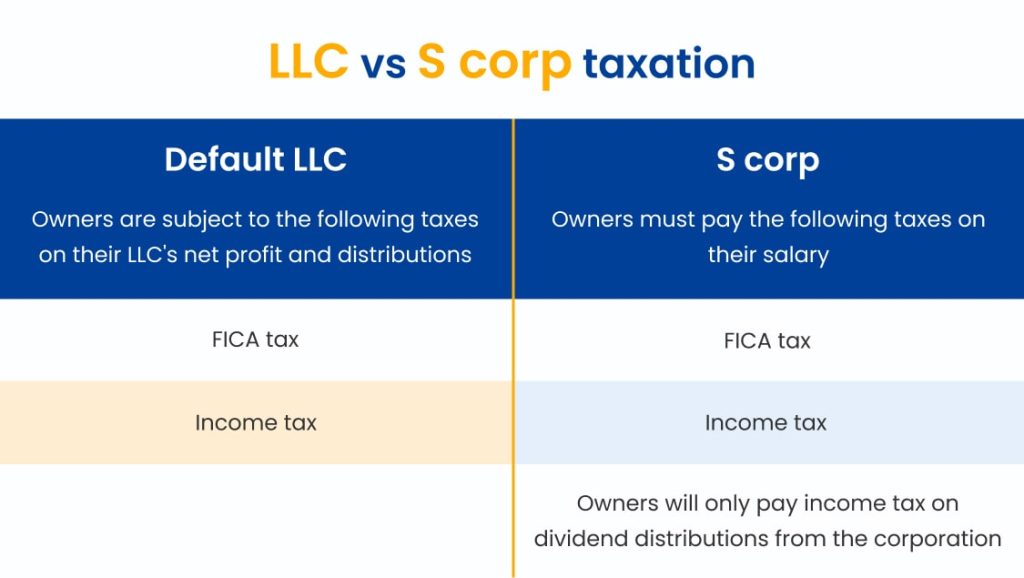

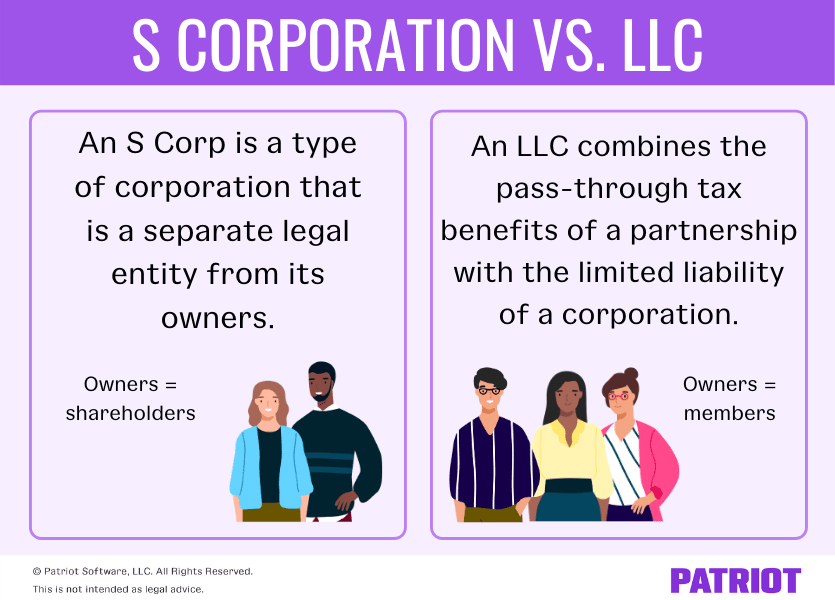

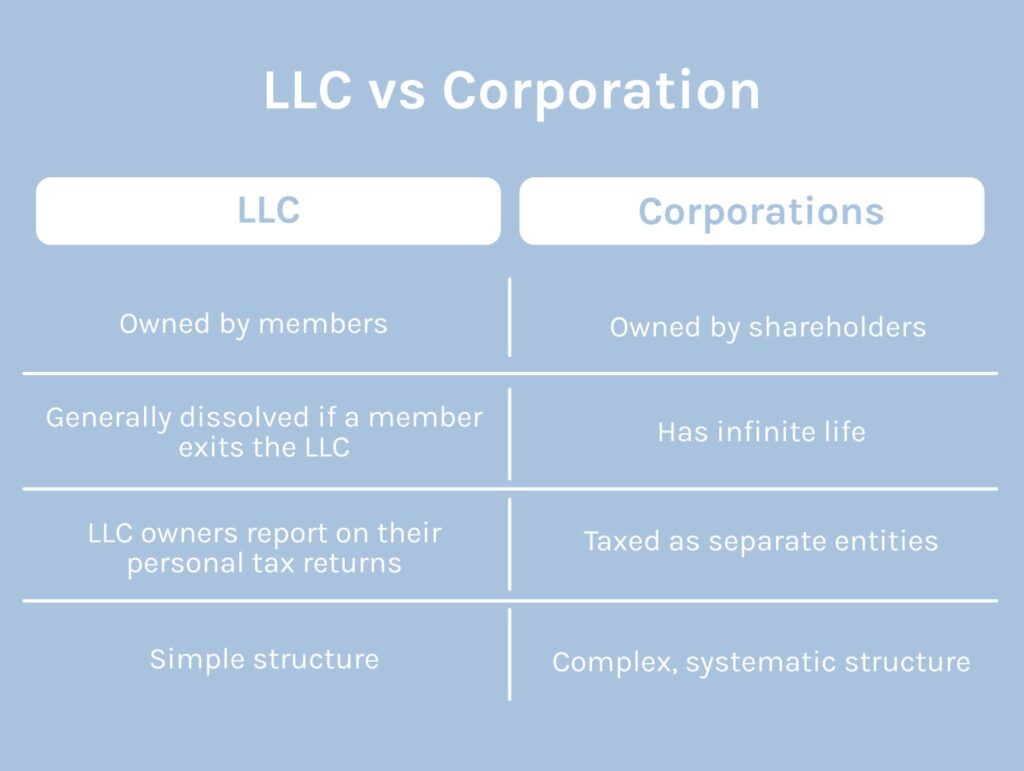

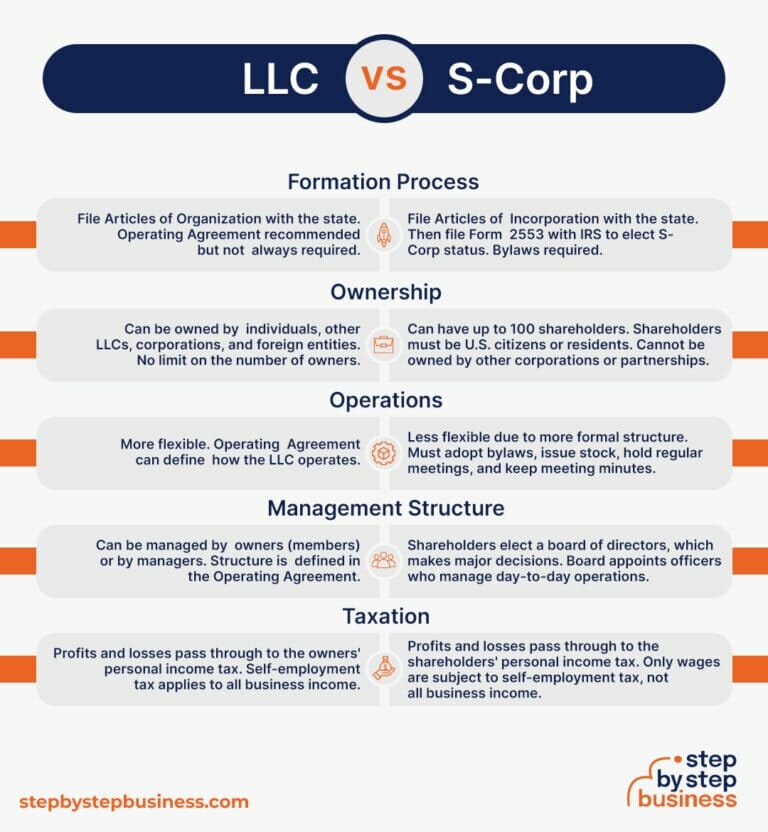

Difference Between S Corporation And Llc - The irs rules restrict s corporation. Which is right for you? This means an llc can attain. As we explained above, an s corp is a tax classification, while an llc is a business entity. There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. What's the difference between an s corp and an llc? An llc is a type of business entity, while an s corporation is a tax classification. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. To be taxed as an s corporation, your business must first register as a c corporation or an llc. A limited liability company (llc) is a legal business structure.

An llc is a type of business entity, while an s corporation is a tax classification. To be taxed as an s corporation, your business must first register as a c corporation or an llc. What's the difference between an s corp and an llc? A limited liability company (llc) is a legal business structure. As we explained above, an s corp is a tax classification, while an llc is a business entity. Which is right for you? The irs rules restrict s corporation. This means an llc can attain. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities.

A limited liability company (llc) is a legal business structure. What's the difference between an s corp and an llc? There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. As we explained above, an s corp is a tax classification, while an llc is a business entity. This means an llc can attain. The irs rules restrict s corporation. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. To be taxed as an s corporation, your business must first register as a c corporation or an llc. Which is right for you? An llc is a type of business entity, while an s corporation is a tax classification.

CCorp vs LLC what's the difference? Latitud

An llc is a type of business entity, while an s corporation is a tax classification. The irs rules restrict s corporation. A limited liability company (llc) is a legal business structure. This means an llc can attain. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for.

CCorp vs LLC what's the difference? Latitud

This means an llc can attain. As we explained above, an s corp is a tax classification, while an llc is a business entity. A limited liability company (llc) is a legal business structure. The irs rules restrict s corporation. To be taxed as an s corporation, your business must first register as a c corporation or an llc.

Detailed Explanation For Difference Between LLC and S Corp

The irs rules restrict s corporation. An llc is a type of business entity, while an s corporation is a tax classification. There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. What's the difference between an s corp and an llc? To be taxed as an s corporation, your business must.

S corp vs. LLC Legalzoom

Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. This means an llc can attain. The irs rules restrict s corporation. A limited liability company (llc) is a legal business structure. There are several key differences between an llc and s corp pertaining to ownership, management,.

S Corp vs. LLC Q&A, Pros & Cons of Each, and More

An llc is a type of business entity, while an s corporation is a tax classification. The irs rules restrict s corporation. Which is right for you? To be taxed as an s corporation, your business must first register as a c corporation or an llc. As we explained above, an s corp is a tax classification, while an llc.

LLC vs Corporation How Does Each Work?

As we explained above, an s corp is a tax classification, while an llc is a business entity. There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. A limited liability company (llc) is a legal business structure. What's the difference between an s corp and an llc? This means an llc.

LLC vs. SCorp Key Differences Step By Step Business

Which is right for you? This means an llc can attain. A limited liability company (llc) is a legal business structure. The irs rules restrict s corporation. To be taxed as an s corporation, your business must first register as a c corporation or an llc.

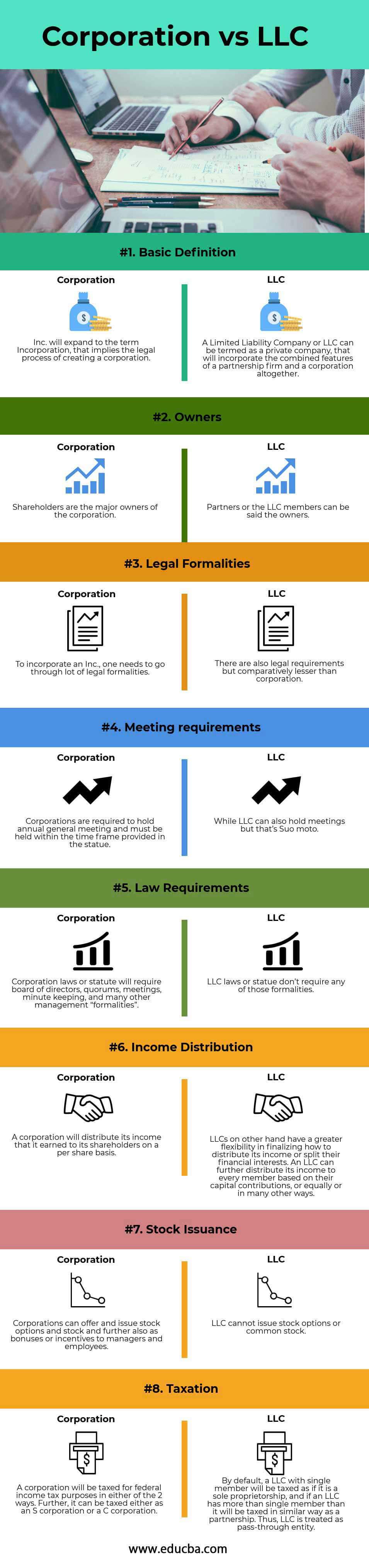

Corporation vs LLC Top 8 Best Differences (With Infographics)

An llc is a type of business entity, while an s corporation is a tax classification. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. As we explained above, an s corp is a tax classification, while an llc is a business entity. There are several.

Should My Llc Be Taxed As An S Corp Or C Corp? registered agent

As we explained above, an s corp is a tax classification, while an llc is a business entity. What's the difference between an s corp and an llc? The irs rules restrict s corporation. This means an llc can attain. There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities.

Corporation vs LLC Information. What are the differences?

A limited liability company (llc) is a legal business structure. An llc is a type of business entity, while an s corporation is a tax classification. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. What's the difference between an s corp and an llc? This.

What's The Difference Between An S Corp And An Llc?

There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. A limited liability company (llc) is a legal business structure. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. To be taxed as an s corporation, your business must first register as a c corporation or an llc.

An Llc Is A Type Of Business Entity, While An S Corporation Is A Tax Classification.

The irs rules restrict s corporation. This means an llc can attain. As we explained above, an s corp is a tax classification, while an llc is a business entity. Which is right for you?