Delaware Annual Report Form

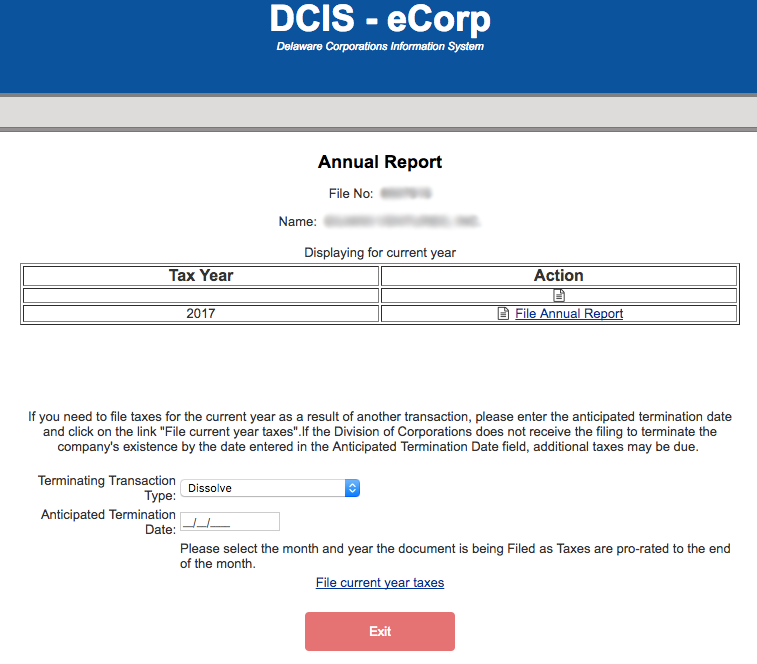

Delaware Annual Report Form - All requests are returned regular usps mail. All corporations incorporated in the state of delaware are required to file an annual report and to pay a franchise tax. A $125.00 filing fee is required to be paid. Any corporation that is incorporated in delaware (regardless of where you conduct business) must file an annual franchise tax report and pay franchise tax for the privilege of incorporating. Please enter your business entity file number below to start filing your annual report or pay taxes. You may select your corporate forms by entity type, by document type or you may select ucc forms. Foreign corporations must file an annual report with the delaware secretary of state on or before june 30 each year. If the annual report and remittance. Exempt domestic corporations do not pay a tax but must file an.

All requests are returned regular usps mail. If the annual report and remittance. You may select your corporate forms by entity type, by document type or you may select ucc forms. Exempt domestic corporations do not pay a tax but must file an. All corporations incorporated in the state of delaware are required to file an annual report and to pay a franchise tax. Any corporation that is incorporated in delaware (regardless of where you conduct business) must file an annual franchise tax report and pay franchise tax for the privilege of incorporating. Please enter your business entity file number below to start filing your annual report or pay taxes. Foreign corporations must file an annual report with the delaware secretary of state on or before june 30 each year. A $125.00 filing fee is required to be paid.

Please enter your business entity file number below to start filing your annual report or pay taxes. You may select your corporate forms by entity type, by document type or you may select ucc forms. All requests are returned regular usps mail. Foreign corporations must file an annual report with the delaware secretary of state on or before june 30 each year. If the annual report and remittance. All corporations incorporated in the state of delaware are required to file an annual report and to pay a franchise tax. A $125.00 filing fee is required to be paid. Any corporation that is incorporated in delaware (regardless of where you conduct business) must file an annual franchise tax report and pay franchise tax for the privilege of incorporating. Exempt domestic corporations do not pay a tax but must file an.

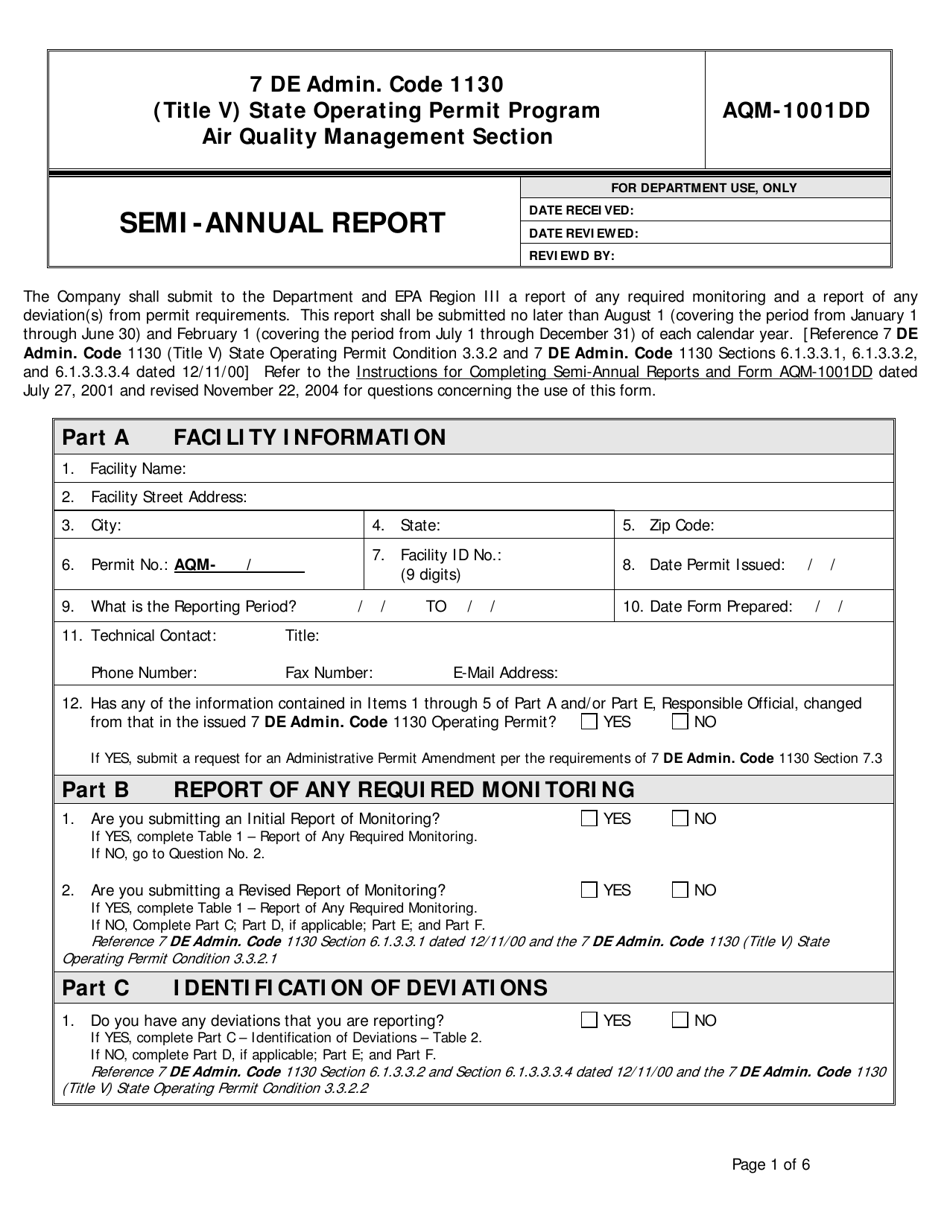

Form AQM1001DD Fill Out, Sign Online and Download Printable PDF

Any corporation that is incorporated in delaware (regardless of where you conduct business) must file an annual franchise tax report and pay franchise tax for the privilege of incorporating. Foreign corporations must file an annual report with the delaware secretary of state on or before june 30 each year. If the annual report and remittance. Exempt domestic corporations do not.

Top 6 Delaware Annual Report Form Templates Free To Download In PDF

Exempt domestic corporations do not pay a tax but must file an. Any corporation that is incorporated in delaware (regardless of where you conduct business) must file an annual franchise tax report and pay franchise tax for the privilege of incorporating. Foreign corporations must file an annual report with the delaware secretary of state on or before june 30 each.

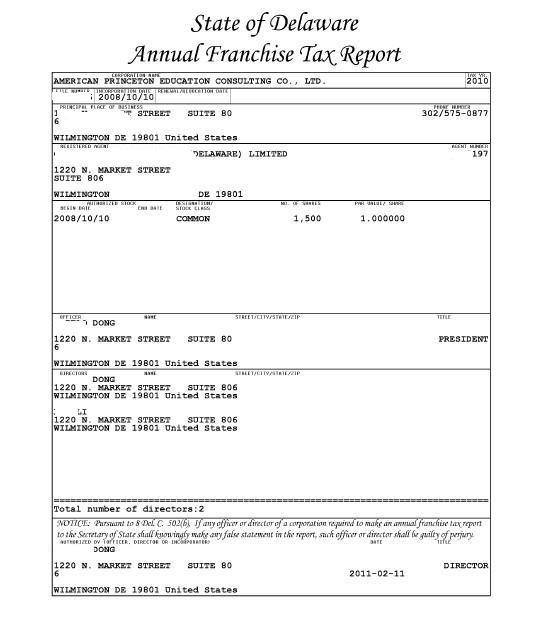

Delaware Annual Franchise Tax Report Form Download

Exempt domestic corporations do not pay a tax but must file an. Please enter your business entity file number below to start filing your annual report or pay taxes. You may select your corporate forms by entity type, by document type or you may select ucc forms. A $125.00 filing fee is required to be paid. Foreign corporations must file.

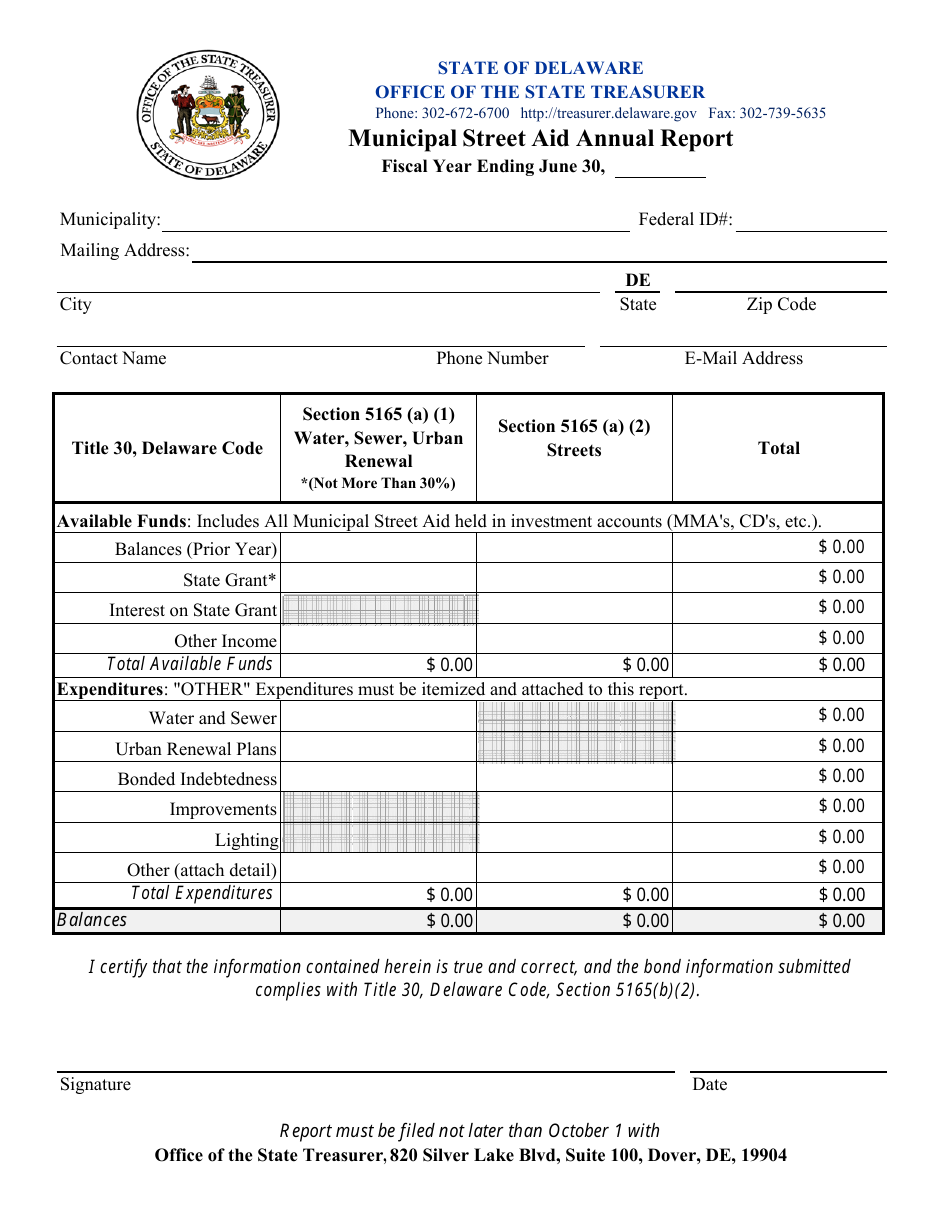

Delaware Municipal Street Aid Annual Report Form Fill Out, Sign

A $125.00 filing fee is required to be paid. If the annual report and remittance. All corporations incorporated in the state of delaware are required to file an annual report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an. All requests are returned regular usps mail.

最新北京代办美国特拉华公司年审Annual Franchise Tax Report攻略海牙认证apostille认证易代通使馆认证网

Exempt domestic corporations do not pay a tax but must file an. Foreign corporations must file an annual report with the delaware secretary of state on or before june 30 each year. All requests are returned regular usps mail. Please enter your business entity file number below to start filing your annual report or pay taxes. All corporations incorporated in.

Delaware Certificate of Organization LLC Bible

Foreign corporations must file an annual report with the delaware secretary of state on or before june 30 each year. All requests are returned regular usps mail. Please enter your business entity file number below to start filing your annual report or pay taxes. Exempt domestic corporations do not pay a tax but must file an. A $125.00 filing fee.

Delaware Annual Report & Franchise Tax The Buzz! Pt 1

Any corporation that is incorporated in delaware (regardless of where you conduct business) must file an annual franchise tax report and pay franchise tax for the privilege of incorporating. If the annual report and remittance. All requests are returned regular usps mail. You may select your corporate forms by entity type, by document type or you may select ucc forms..

Delaware Franchise Tax 2024 Merci Ludovika

Exempt domestic corporations do not pay a tax but must file an. You may select your corporate forms by entity type, by document type or you may select ucc forms. Foreign corporations must file an annual report with the delaware secretary of state on or before june 30 each year. All requests are returned regular usps mail. Please enter your.

Delaware LLC Annual Report File an LLC Annual Report in Delaware

If the annual report and remittance. You may select your corporate forms by entity type, by document type or you may select ucc forms. Exempt domestic corporations do not pay a tax but must file an. All corporations incorporated in the state of delaware are required to file an annual report and to pay a franchise tax. Please enter your.

2020 YMCA of Delaware Annual Report by YMCA of Delaware Issuu

If the annual report and remittance. Any corporation that is incorporated in delaware (regardless of where you conduct business) must file an annual franchise tax report and pay franchise tax for the privilege of incorporating. All requests are returned regular usps mail. A $125.00 filing fee is required to be paid. Please enter your business entity file number below to.

Exempt Domestic Corporations Do Not Pay A Tax But Must File An.

All corporations incorporated in the state of delaware are required to file an annual report and to pay a franchise tax. Foreign corporations must file an annual report with the delaware secretary of state on or before june 30 each year. You may select your corporate forms by entity type, by document type or you may select ucc forms. Please enter your business entity file number below to start filing your annual report or pay taxes.

If The Annual Report And Remittance.

Any corporation that is incorporated in delaware (regardless of where you conduct business) must file an annual franchise tax report and pay franchise tax for the privilege of incorporating. A $125.00 filing fee is required to be paid. All requests are returned regular usps mail.