Columbus Ohio Local Tax

Columbus Ohio Local Tax - The deadline for filing 2023 individual tax returns is april 15, 2024. Lookup your taxing jurisdiction on crisp.columbus.gov. You are responsible for paying additional tax if the tax rate where you. Everything you need to file can be found on the filing season information page. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and.

You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. Everything you need to file can be found on the filing season information page. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. You are responsible for paying additional tax if the tax rate where you. The deadline for filing 2023 individual tax returns is april 15, 2024. Lookup your taxing jurisdiction on crisp.columbus.gov. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all.

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. Everything you need to file can be found on the filing season information page. The deadline for filing 2023 individual tax returns is april 15, 2024. You are responsible for paying additional tax if the tax rate where you. Lookup your taxing jurisdiction on crisp.columbus.gov. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated.

Exclusive Tax Service Columbus GA

Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. You are responsible for paying additional tax if the tax rate where you. We strongly recommend you.

NAACP Youth Council Columbus GA Columbus GA

Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. Everything you need to file can be found on the filing season information page. It is quick, secure and convenient! Lookup your taxing jurisdiction on crisp.columbus.gov. The finder, from the ohio department of taxation, provides information.

Breweries in Columbus Ohio Visit Ohio Today

It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). The deadline for filing 2023 individual tax returns is april 15, 2024. You are responsible for paying additional tax if the tax rate where you. Lookup your taxing jurisdiction on crisp.columbus.gov.

COLUMBUS OHIO BOUNCE HOUSE RENTALS COLUMBUS OHIO INFLATABLE SLIDE

Lookup your taxing jurisdiction on crisp.columbus.gov. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Employer tax forms paper return delays we strongly recommend you file and pay.

Who Decides Local Values for Ohio Real Estate Tax County Auditor or

Everything you need to file can be found on the filing season information page. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. You are responsible for paying additional tax if the tax rate where you. It is quick, secure and convenient! Employer tax forms paper return delays we.

The Recovery Village Columbus Drug and Alcohol Rehab Columbus OH

The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. Lookup your taxing jurisdiction on crisp.columbus.gov. Residents of columbus pay a flat city income tax of 2.50%.

Historic Columbus Columbus GA

The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. The deadline for filing 2023 individual tax returns is april 15, 2024. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). You are responsible for paying additional tax if the tax rate where you. Lookup.

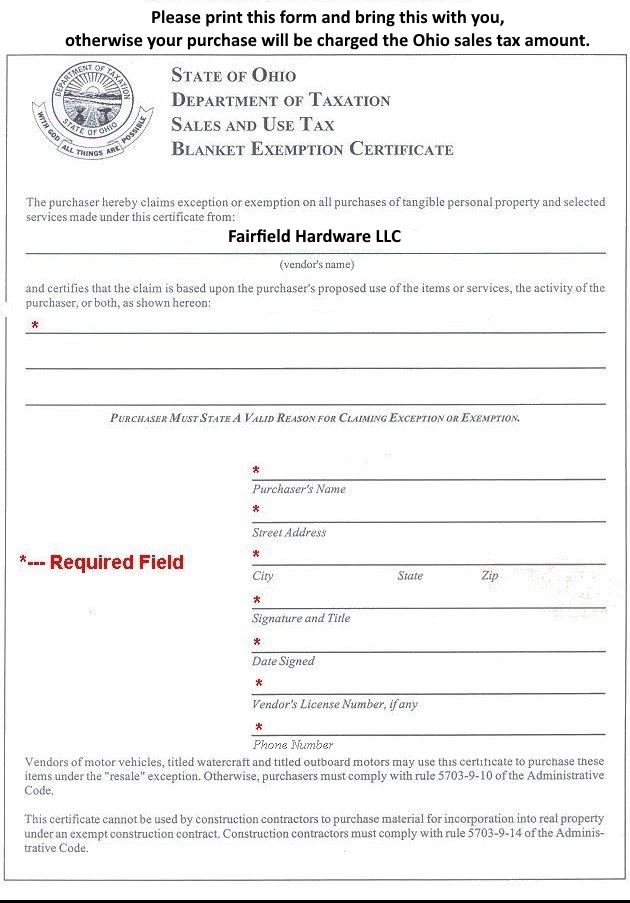

Fairfield Hardware Ohio Tax Exemption Form

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Everything you need to file can be found on the filing season information page. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. Employer tax forms paper return.

Annex of Columbus Columbus IN

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). You are responsible for paying additional tax if the tax rate where you. It is quick, secure and convenient! The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Employer tax forms paper return delays we.

Ohio Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. You are responsible for paying additional tax if the tax rate where you..

Lookup Your Taxing Jurisdiction On Crisp.columbus.gov.

Employer tax forms paper return delays we strongly recommend you file and pay with our new online tax portal, crisp.it is quick, secure and. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. The deadline for filing 2023 individual tax returns is april 15, 2024. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax.

We Strongly Recommend You File And Pay With Our New Online Tax Portal Crisp (Crisp.columbus.gov).

You are responsible for paying additional tax if the tax rate where you. Everything you need to file can be found on the filing season information page. It is quick, secure and convenient! You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated.