Columbus Ohio Income Tax Forms

Columbus Ohio Income Tax Forms - We strongly recommend you file and pay with our new online tax portal, crisp. Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. We strongly recommend you file and pay with our new online tax portal, crisp. Payments can be made on crisp (crisp.columbus.gov) or. Click here to download paper forms; We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. Declaration and estimated tax payments must be made separately from your tax return. It is quick, secure and convenient!

Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! Payments can be made on crisp (crisp.columbus.gov) or. Declaration and estimated tax payments must be made separately from your tax return. It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. Click here to download paper forms;

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! It is quick, secure and convenient! Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. We strongly recommend you file and pay with our new online tax portal, crisp. Click here to download paper forms; Payments can be made on crisp (crisp.columbus.gov) or. It is quick, secure and convenient! For options to obtain paper forms from the ohio department of taxation:

OH Tax Return Bryan City 20182022 Fill and Sign Printable

It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! It is quick, secure and convenient! For options to obtain paper forms from the ohio department of taxation:

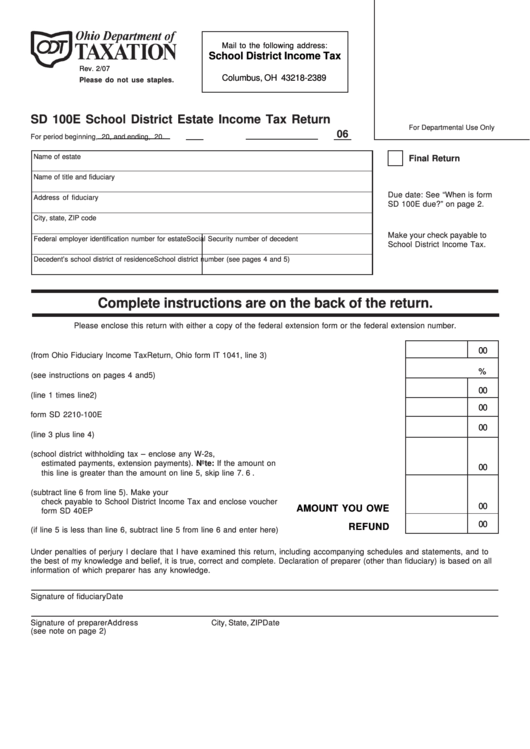

Fillable Form Sd 100e School District Estate Tax Return Form

Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. It is quick, secure and convenient! For options to obtain paper forms from the ohio department of taxation: We strongly recommend you file and pay with our new online tax portal, crisp. Click here to.

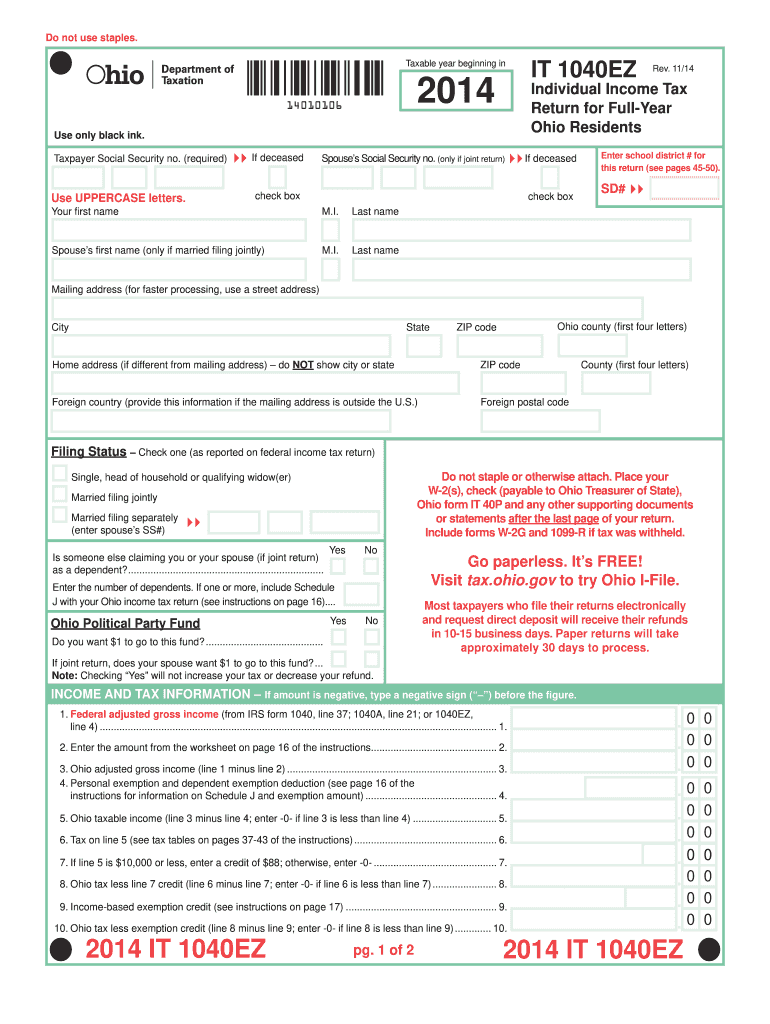

2014 ohio tax Fill out & sign online DocHub

Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. It is quick, secure and convenient! It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. For options to obtain paper forms from the ohio.

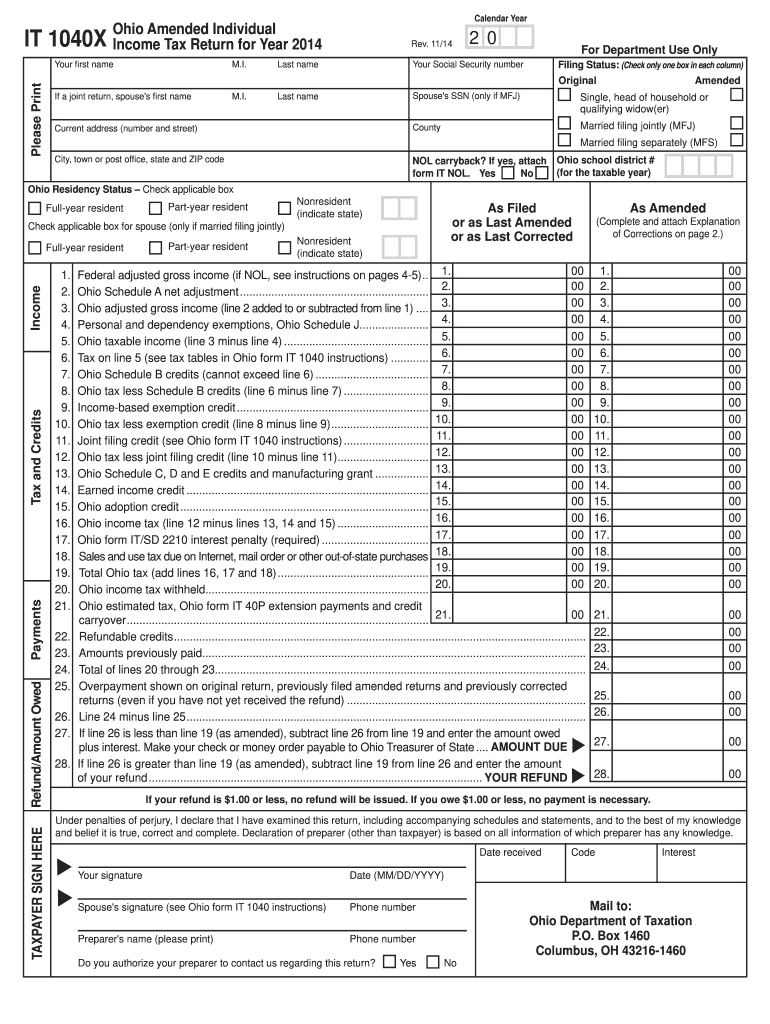

Ohio tax return individual Fill out & sign online DocHub

We strongly recommend you file and pay with our new online tax portal, crisp. Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. It is quick, secure and convenient! For options to obtain paper forms from the ohio department of taxation: We strongly recommend.

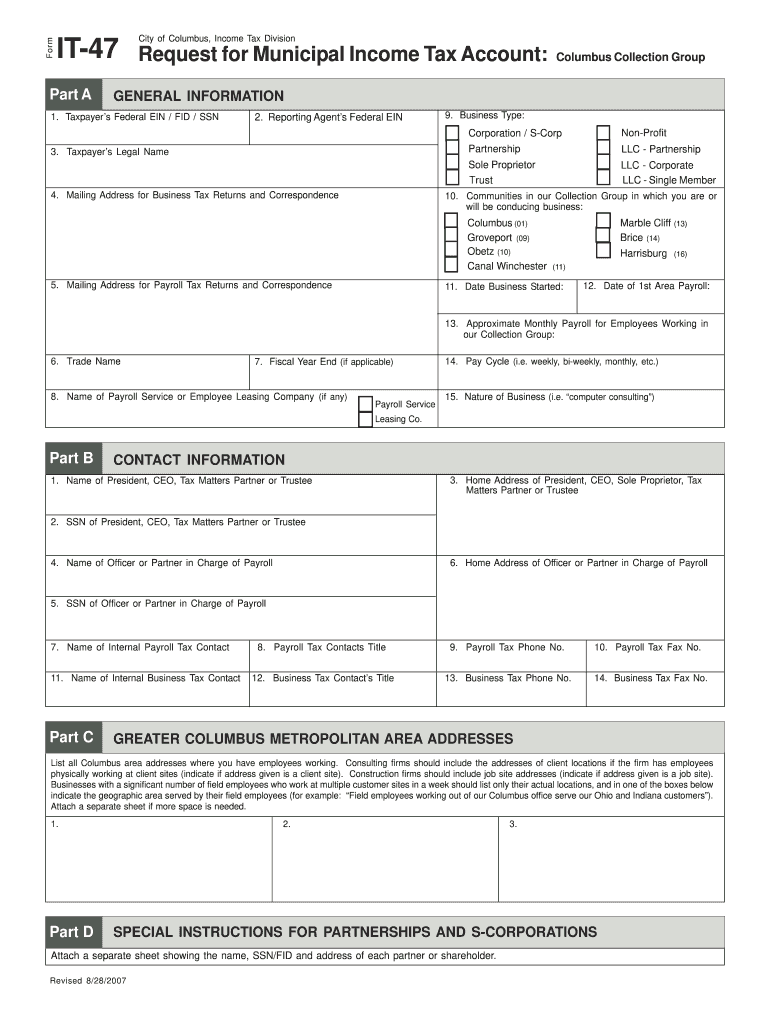

Fillable Online City of Columbus Tax Division Instructions for

Declaration and estimated tax payments must be made separately from your tax return. We strongly recommend you file and pay with our new online tax portal, crisp. We strongly recommend you file and pay with our new online tax portal, crisp. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Taxpayers who owe $200.

Ohio 00 20142024 Form Fill Out and Sign Printable PDF Template

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp. It is quick, secure and convenient! For options to obtain paper forms from the ohio department of taxation:

Form it 47 Request for Municipal Tax Account Columbus Tax

Click here to download paper forms; For options to obtain paper forms from the ohio department of taxation: It is quick, secure and convenient! Payments can be made on crisp (crisp.columbus.gov) or. Declaration and estimated tax payments must be made separately from your tax return.

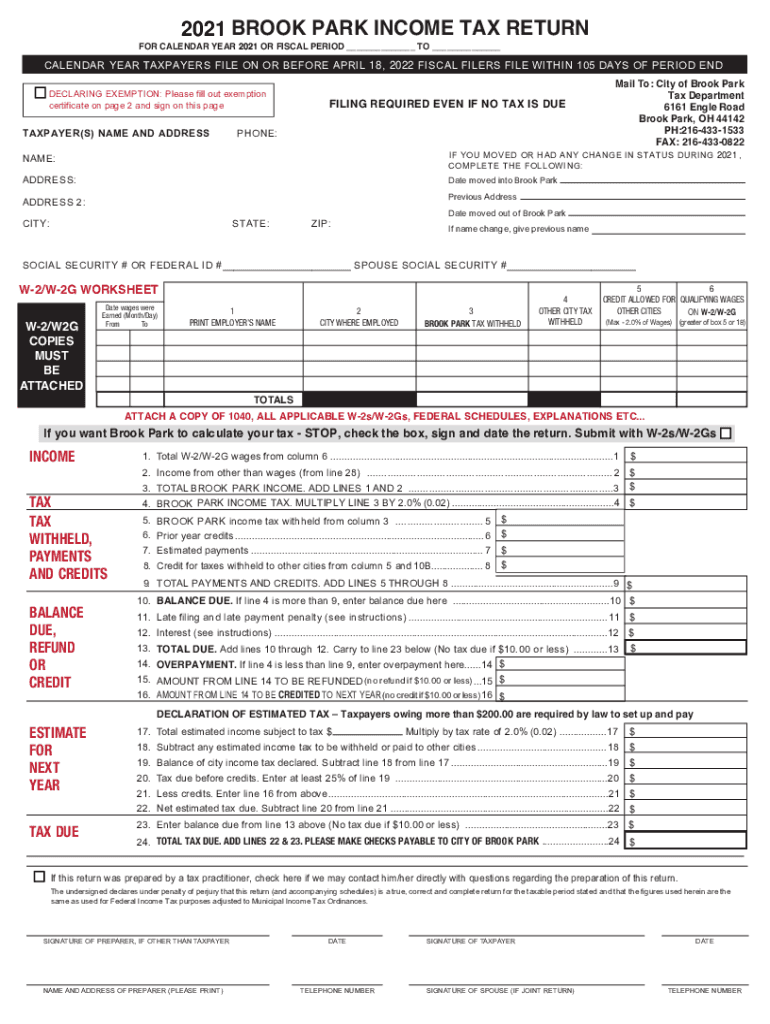

2021 Form OH Brook Park Tax Return Fill Online, Printable

It is quick, secure and convenient! Click here to download paper forms; Payments can be made on crisp (crisp.columbus.gov) or. Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. We strongly recommend you file and pay with our new online tax portal, crisp.

Fillable Online tax ohio Ohio Tax Forms 2020 (for Tax Year

It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). We strongly recommend you file and pay with our new online tax portal, crisp. For options to obtain paper forms from the ohio department of taxation: It is quick, secure and convenient!

Tax Printable Forms Printable Forms Free Online

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! It is quick, secure and convenient! Payments can be made on crisp (crisp.columbus.gov) or. For options to obtain paper forms from the ohio department of taxation:

For Options To Obtain Paper Forms From The Ohio Department Of Taxation:

Taxpayers who owe $200 or more in tax for the current tax year (part a line 8) are required to make quarterly estimated tax payments. We strongly recommend you file and pay with our new online tax portal, crisp. Declaration and estimated tax payments must be made separately from your tax return. It is quick, secure and convenient!

We Strongly Recommend You File And Pay With Our New Online Tax Portal Crisp (Crisp.columbus.gov).

It is quick, secure and convenient! It is quick, secure and convenient! It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal, crisp.

Payments Can Be Made On Crisp (Crisp.columbus.gov) Or.

Click here to download paper forms; We strongly recommend you file and pay with our new online tax portal, crisp.