Can You Purchase A Home With A Tax Lien

Can You Purchase A Home With A Tax Lien - Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. The buyer can include the lien in their offer, but the seller can use a short sale to sell. It’s simply a matter of doing your homework on the reason for the. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. But what happens to those houses. Read about buying tax lien properties and how to invest in them. Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. You can buy a home with a lien against it, but the seller must clear the lien before the sale. This article takes a deep dive into everything you should know about homes and.

It’s simply a matter of doing your homework on the reason for the. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. You can buy a home with a lien against it, but the seller must clear the lien before the sale. This article takes a deep dive into everything you should know about homes and. The buyer can include the lien in their offer, but the seller can use a short sale to sell. But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). But what happens to those houses. Read about buying tax lien properties and how to invest in them.

You can buy a home with a lien against it, but the seller must clear the lien before the sale. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. The buyer can include the lien in their offer, but the seller can use a short sale to sell. This article takes a deep dive into everything you should know about homes and. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. It’s simply a matter of doing your homework on the reason for the. Read about buying tax lien properties and how to invest in them. Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. But what happens to those houses.

Why Tax Lien Investing A Good Business? Tax Lien Certificate School

But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. It’s simply a matter of doing your homework on the reason for the. You can buy a home with a lien against it, but the seller must clear the lien before the sale. Buying a tax lien.

SELL MY HOUSE EVEN WITH A TAX LIEN WE BUY FAST AND CASH

Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). This article takes a deep dive into everything you should know about homes and. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes..

Tax Lien Sales Can You Buy Tax Lien Properties to Save Big?

Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. The buyer can include the lien in their offer, but the.

How To Purchase Tax Lien Properties Part 1 With Bill Williams Tax

But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. The buyer can include the lien in their offer, but the seller can use a short sale to sell. Buying a tax lien gives you a legal claim on a home if the owner fails to repay.

Real Property Tax Lien Hymson Goldstein Pantiliat & Lohr, PLLC

Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. It’s simply a matter of doing your homework on the reason for the. But what happens to those houses. You can buy a home with a lien against it, but the seller must clear the lien before the sale. This.

How to Buy Tax Lien and Auction Properties (Live Webinar + Replay)

Read about buying tax lien properties and how to invest in them. This article takes a deep dive into everything you should know about homes and. It’s simply a matter of doing your homework on the reason for the. Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you.

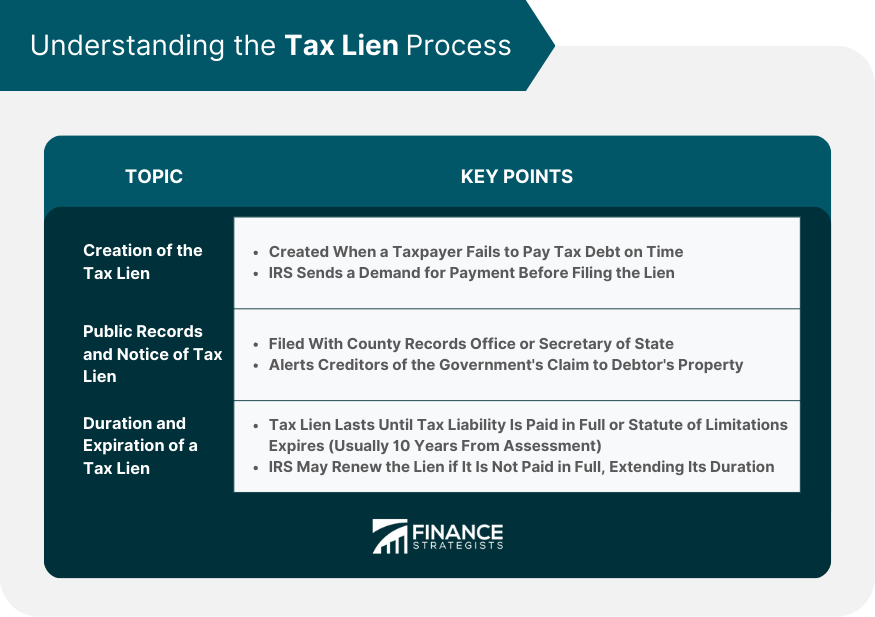

What Causes a Tax Lien? Clean Slate Tax

This article takes a deep dive into everything you should know about homes and. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. You can buy a home with a lien against it, but the seller must clear the lien before the sale. Buying a tax lien gives you a legal.

Tax Lien Definition, Process, Consequences, How to Handle

Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). The buyer can include the lien in their offer, but the seller can use a short sale to sell. But more often than not, a tax lien on a property doesn’t need to get.

Property Tax Lien Search Nationwide Title Insurance

It’s simply a matter of doing your homework on the reason for the. But what happens to those houses. This article takes a deep dive into everything you should know about homes and. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. The buyer can include the lien in their offer,.

Tax Lien Investing For Beginners FortuneBuilders

However, buying a house with a tax lien can be risky if you don’t know what you’re doing. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. But what happens to those houses. Normally when you buy a house, you don’t want a home with any outstanding liens against.

Normally When You Buy A House, You Don’t Want A Home With Any Outstanding Liens Against It (That’s Also Why You Pay For A Title Company).

It’s simply a matter of doing your homework on the reason for the. This article takes a deep dive into everything you should know about homes and. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. You can buy a home with a lien against it, but the seller must clear the lien before the sale.

The Buyer Can Include The Lien In Their Offer, But The Seller Can Use A Short Sale To Sell.

Read about buying tax lien properties and how to invest in them. But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. But what happens to those houses.