Buying Tax Lien Homes

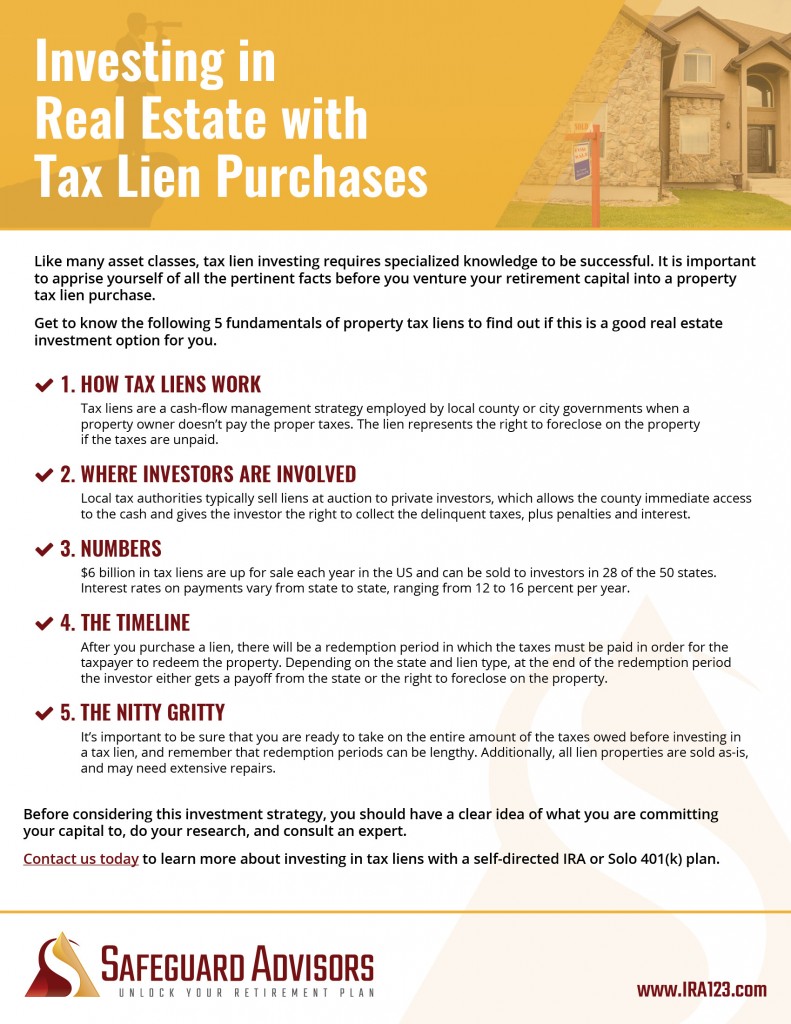

Buying Tax Lien Homes - Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. Whether you're new to real estate or an experienced investor, we'll cover the basics of buying tax. This guide is for people who want to understand how to buy tax lien homes. These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. When individuals or businesses fail to pay their. Read about buying tax lien properties and how to invest in them. Once an investor buys that claim, they. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Purchasing tax liens can be a lucrative though relatively risky business for those who are knowledgeable about real estate.

This guide is for people who want to understand how to buy tax lien homes. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. When individuals or businesses fail to pay their. These certificates give investors the right to collect unpaid property taxes, interest. Purchasing tax liens can be a lucrative though relatively risky business for those who are knowledgeable about real estate. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. Whether you're new to real estate or an experienced investor, we'll cover the basics of buying tax. Read about buying tax lien properties and how to invest in them. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Once an investor buys that claim, they.

Read about buying tax lien properties and how to invest in them. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Purchasing tax liens can be a lucrative though relatively risky business for those who are knowledgeable about real estate. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. Once an investor buys that claim, they. This guide is for people who want to understand how to buy tax lien homes. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Whether you're new to real estate or an experienced investor, we'll cover the basics of buying tax. These certificates give investors the right to collect unpaid property taxes, interest. When individuals or businesses fail to pay their.

Comprehensive Guide How to Buy Tax Lien Homes and Where to Find Them

Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. These certificates give investors the right to collect unpaid property taxes, interest. When individuals or businesses fail to pay their. Buying a tax lien gives you a legal claim on a home if the owner fails.

Buying Tax Lien Homes At Topped Oof Price Cheap Sale

Once an investor buys that claim, they. Whether you're new to real estate or an experienced investor, we'll cover the basics of buying tax. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. Tax lien investing is a type of real estate investing where you purchase tax lien certificates.

Buying Tax Lien Homes At Topped Oof Price Cheap Sale

Purchasing tax liens can be a lucrative though relatively risky business for those who are knowledgeable about real estate. Whether you're new to real estate or an experienced investor, we'll cover the basics of buying tax. When individuals or businesses fail to pay their. These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing involves.

Causes and Process of Buying Tax Lien Properties PDF

Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Read about buying tax lien properties and how to invest in them. When individuals or businesses fail to pay their. Whether you're.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

These certificates give investors the right to collect unpaid property taxes, interest. Whether you're new to real estate or an experienced investor, we'll cover the basics of buying tax. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Read about buying tax lien properties and how to invest in them. Buying.

Buying Tax Lien Homes At Topped Oof Price Shop

When individuals or businesses fail to pay their. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. This guide is for people who want to understand how to buy tax lien homes. Whether you're new to real estate or an experienced investor, we'll cover the basics of buying tax. Purchasing tax.

What to Look For When Buying Tax Deeds Tax Lien Certificate School

These certificates give investors the right to collect unpaid property taxes, interest. Once an investor buys that claim, they. This guide is for people who want to understand how to buy tax lien homes. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. When individuals.

Tax Lien Sale PDF Tax Lien Taxes

Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Once an investor buys.

How to Buy Government Owned Tax Lien Homes (with Pictures)

These certificates give investors the right to collect unpaid property taxes, interest. Once an investor buys that claim, they. This guide is for people who want to understand how to buy tax lien homes. Purchasing tax liens can be a lucrative though relatively risky business for those who are knowledgeable about real estate. Tax lien investing is a type of.

How to Buy Government Owned Tax Lien Homes (with Pictures)

When individuals or businesses fail to pay their. Read about buying tax lien properties and how to invest in them. Once an investor buys that claim, they. This guide is for people who want to understand how to buy tax lien homes. These certificates give investors the right to collect unpaid property taxes, interest.

When Individuals Or Businesses Fail To Pay Their.

Once an investor buys that claim, they. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Purchasing tax liens can be a lucrative though relatively risky business for those who are knowledgeable about real estate. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes.

Read About Buying Tax Lien Properties And How To Invest In Them.

This guide is for people who want to understand how to buy tax lien homes. Whether you're new to real estate or an experienced investor, we'll cover the basics of buying tax. These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes.