Illinois Law - Statute Of Limitations Property Tax Lien

Illinois Law - Statute Of Limitations Property Tax Lien - Illinois may have more current or accurate. (a) if a taxpayer owes arrearages of taxes for a. When the state creates a lien on real property under the public aid code, the lien shall be enforceable for 5 years from the date. Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. Statute of limitation for collection of delinquent real estate taxes and special assessments. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. (c) an applicant may file a petition to substitute a bond for the property subject to a lien claim with the clerk of the circuit court of the county in. Actions for the collection of any delinquent installments of special assessments or special taxes, or the enforcement or foreclosure. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. These codes may not be the most recent version.

Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. Statute of limitation for collection of delinquent real estate taxes and special assessments. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. These codes may not be the most recent version. (c) an applicant may file a petition to substitute a bond for the property subject to a lien claim with the clerk of the circuit court of the county in. (a) if a taxpayer owes arrearages of taxes for a. When the state creates a lien on real property under the public aid code, the lien shall be enforceable for 5 years from the date. Illinois may have more current or accurate. Actions for the collection of any delinquent installments of special assessments or special taxes, or the enforcement or foreclosure.

These codes may not be the most recent version. When the state creates a lien on real property under the public aid code, the lien shall be enforceable for 5 years from the date. Illinois may have more current or accurate. Actions for the collection of any delinquent installments of special assessments or special taxes, or the enforcement or foreclosure. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. (c) an applicant may file a petition to substitute a bond for the property subject to a lien claim with the clerk of the circuit court of the county in. Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. Statute of limitation for collection of delinquent real estate taxes and special assessments. (a) if a taxpayer owes arrearages of taxes for a.

Will other states follow Pennsylvania’s new statute of limitations tax

Statute of limitation for collection of delinquent real estate taxes and special assessments. When the state creates a lien on real property under the public aid code, the lien shall be enforceable for 5 years from the date. (a) if a taxpayer owes arrearages of taxes for a. The lien remains until the debt is fully satisfied or becomes unenforceable.

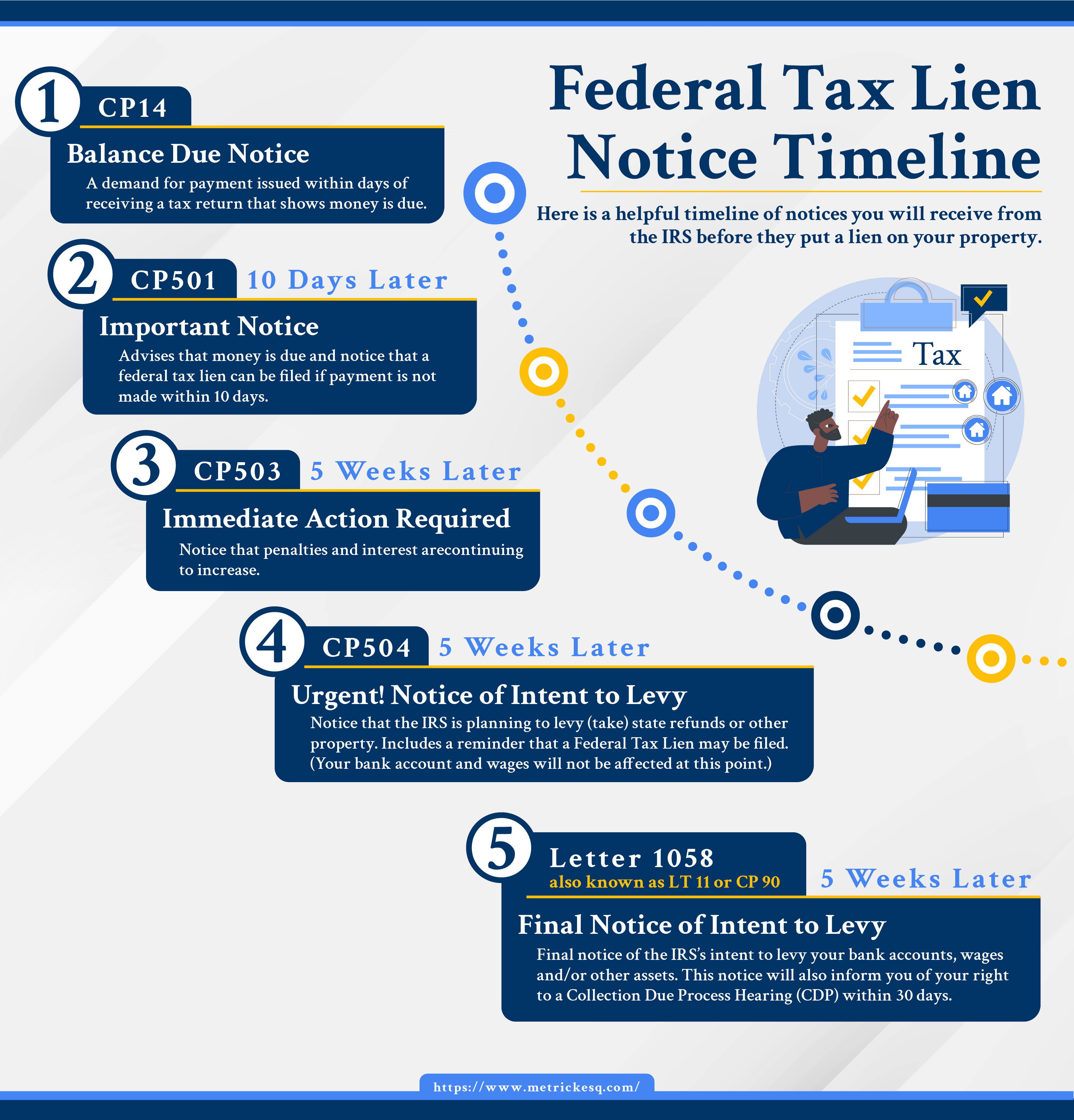

Federal Tax Lien Statute Of Limitations Get What You Need For Free

Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. When the state creates a lien on real property under the public aid code, the lien shall be enforceable for 5 years from the date. Actions for the collection of any delinquent installments of special assessments or special taxes,.

Sumsion Business Law Website

When the state creates a lien on real property under the public aid code, the lien shall be enforceable for 5 years from the date. These codes may not be the most recent version. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. (c) an applicant may.

Irs tax lien statute of limitations Fill online, Printable, Fillable

The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. When the state creates a lien on real property under the public aid code, the lien shall be enforceable for 5 years from the date. These codes may not be the most recent version. (a) if a taxpayer.

Statute of Limitations on Personal Injury Cases in Illinois

(c) an applicant may file a petition to substitute a bond for the property subject to a lien claim with the clerk of the circuit court of the county in. Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. These codes may not be the most recent version..

Federal Tax Lien Statute Of Limitations Get What You Need For Free

The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and. (c) an applicant may file a petition to substitute a bond for the property subject to a lien claim with the clerk of the circuit court of the county in. The lien remains until the.

Statute of Limitations for New Jersey Tax Audits Paladini Law

Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. Statute of limitation for collection of delinquent real estate taxes and special assessments. Actions for the collection of any delinquent installments of special assessments or special taxes, or the enforcement or foreclosure. Illinois may have more current or accurate..

Federal Tax Lien Statute Of Limitations Get What You Need For Free

These codes may not be the most recent version. (a) if a taxpayer owes arrearages of taxes for a. Statute of limitation for collection of delinquent real estate taxes and special assessments. Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. (c) an applicant may file a petition.

IRS Statute of Limitations What It is!! How to use It!! TorchLight Tax

When the state creates a lien on real property under the public aid code, the lien shall be enforceable for 5 years from the date. These codes may not be the most recent version. Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. Actions for the collection of.

Is There a Statute of Limitations for a IRS Tax Lien? Clean Slate Tax

Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. Actions for the collection of any delinquent installments of special assessments or special taxes, or the enforcement or foreclosure. These codes may not be the most recent version. (c) an applicant may file a petition to substitute a bond.

When The State Creates A Lien On Real Property Under The Public Aid Code, The Lien Shall Be Enforceable For 5 Years From The Date.

Actions for the collection of any delinquent installments of special assessments or special taxes, or the enforcement or foreclosure. These codes may not be the most recent version. (c) an applicant may file a petition to substitute a bond for the property subject to a lien claim with the clerk of the circuit court of the county in. The liens included in the state tax lien registry are liens filed by idor or the department of employment security on the real property and.

Illinois May Have More Current Or Accurate.

Once a liability has been deemed assessed or finalized, the statute of limitations to use enforcement collection action varies from 2. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. Statute of limitation for collection of delinquent real estate taxes and special assessments. (a) if a taxpayer owes arrearages of taxes for a.