2.5 Tax $679 Semimonthly Find The Local Tax Deducted

2.5 Tax $679 Semimonthly Find The Local Tax Deducted - Identify the given values in the question. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the. View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. This can be done by multiplying $679 by 0.025. Find the local tax deducted., 1 3/4% tax, $43210. The local tax deducted is $16.98. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Explanation the given question is related to math. Also, use a 0.05 significance level and state the conclusion about the null hypothesis.

To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. Also, use a 0.05 significance level and state the conclusion about the null hypothesis. The local tax deducted is $16.98. Identify the given values in the question. Item 1 find the amount of the fica. Find the local tax deducted., 1 3/4% tax, $43210. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. This can be done by multiplying $679 by 0.025. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly:

Item 1 find the amount of the fica. Identify the given values in the question. Explanation the given question is related to math. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. This can be done by multiplying $679 by 0.025. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. Find the local tax deducted., 1 3/4% tax, $43210. Also, use a 0.05 significance level and state the conclusion about the null hypothesis.

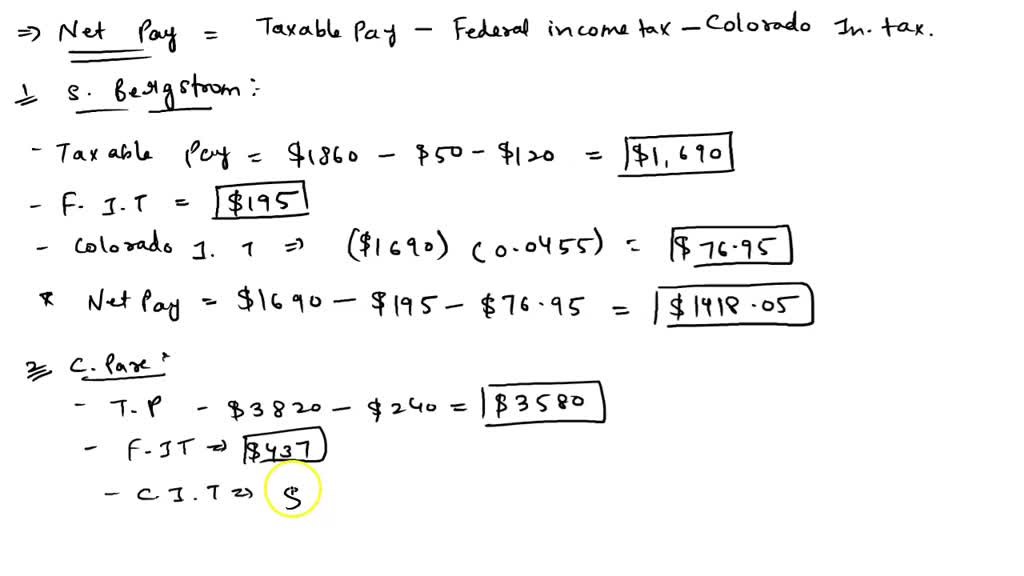

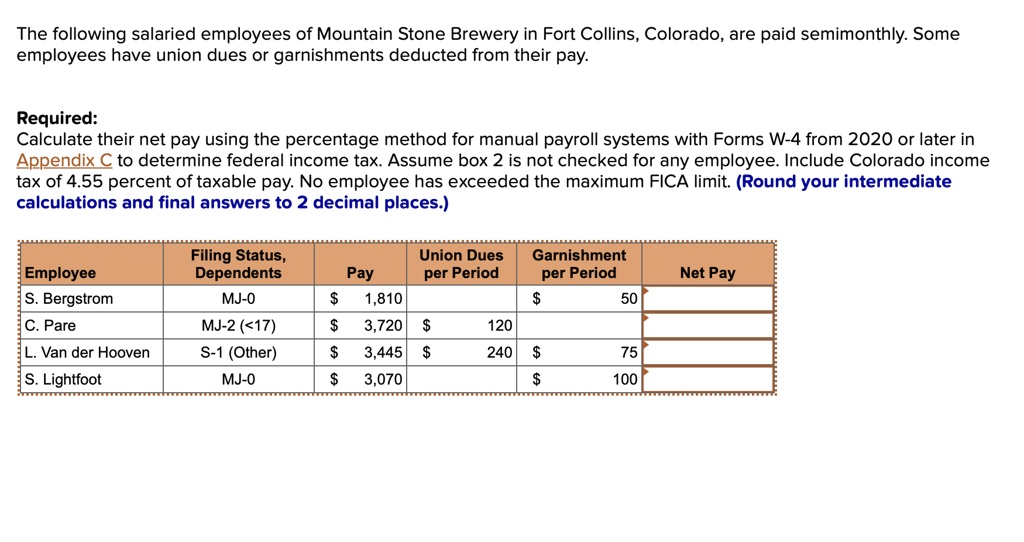

The following salaried employees of Mountain Stone Brewery in Fort

Explanation the given question is related to math. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Item 1 find the amount of the fica. Identify the given values in the question. This can be done by multiplying $679 by 0.025.

Frequently asked questions on Tax Deducted at Source (TDS) the

Find the local tax deducted., 1 3/4% tax, $43210. To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: For question #2 to find the amount of social security tax deducted from the given pay period you would need to.

How to get refund of Tax Deducted under section 195 Legal Suvidha Blog

Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the..

Soda Tax TaxEDU Glossary

Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the. Identify the given values in the question. Item 1 find the amount of the fica. Also, use a 0.05 significance level and state.

Perbandingan Local Tax Berbagai Negara PDF Taxes Property Tax

This can be done by multiplying $679 by 0.025. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. Explanation the given question is related to math. Identify the given values in the question.

Understanding Tax Deducted at Source (TDS)

Identify the given values in the question. Find the local tax deducted., 1 3/4% tax, $43210. View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Item 1 find the amount of the fica.

Tax Deducted at Source Form 26 AS What and How?

Explanation the given question is related to math. Identify the given values in the question. To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the. Find the local tax.

Combined State and Average Local Sales Tax Rates Tax Foundation

Item 1 find the amount of the fica. Identify the given values in the question. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: For question #2 to find the amount of social security tax deducted from.

Ultimate Guide to Tax Deducted at Source in GST

Find the local tax deducted., 1 3/4% tax, $43210. For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Explanation the given question is related to math..

The following salaried employees of Mountain Stone Brewery in Fort

This can be done by multiplying $679 by 0.025. Find the local tax deducted., 1 3/4% tax, $43210. Item 1 find the amount of the fica. For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the. The local tax deducted is $16.98.

Item 1 Find The Amount Of The Fica.

For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the. View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. This can be done by multiplying $679 by 0.025. Also, use a 0.05 significance level and state the conclusion about the null hypothesis.

Explanation The Given Question Is Related To Math.

The local tax deducted is $16.98. Identify the given values in the question. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Find the local tax deducted., 1 3/4% tax, $43210.

Study With Quizlet And Memorize Flashcards Containing Terms Like 2.5% Tax, $679 Semimonthly:

To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679.

.png)